REAL ESTATE ACCOUNTING & TAX SERVICES

Maximize Returns and Minimize Headaches

We help you structure entities, track cash flow, and optimize taxes across every property—so your portfolio works harder while you work less.

Every Property Tells a Story, and the Numbers Should Too

Every property you own adds more complexity — more entities, more loans, more moving parts.

Iota Finance keeps it all connected. We design accounting, CFO, and tax systems that work together to show exactly how your portfolio performs — by property, by project, by partner. You’ll know where cash is tied up, which investments deliver, and how to structure the next deal for maximum return.

Whether you’re building long-term rental income, scaling short-term rentals, or managing properties for others, we give you the financial clarity to run your business like a true enterprise.

See How A Bookkeeping & Tax Cleanup Saved These Real Estate Investors Over $730K in Taxes

When a growing real estate company came to us with a complex multi-entity structure and over 20,000 miscategorized calculations across 6+ years, we rebuilt their accounting foundation and restructured their approach—resulting in over $734,000 in tax savings.

Accounting for Real Estate Investors

You’re building long-term wealth — but every property adds another layer of accounting complexity. We help you stay ahead of it all: entity structuring, depreciation schedules, cash flow tracking, and smart use of paper losses to minimize tax exposure.

With accurate books and proactive tax planning, you’ll know exactly how your portfolio performs — and where your next dollar should go.

Accounting for Short-Term Rental Operators

Managing short-term rentals isn’t passive income — it’s a full-time operation. Between changing regulations, platform fees, and local occupancy taxes, profitability can disappear fast.

We help you navigate the compliance maze, automate your accounting, and build a clear financial picture of each property’s true performance. The result: more confidence, fewer surprises, and a business built to scale.

Accounting for Property Managers

You’re responsible for everything — tenant payments, owner reports, maintenance expenses, payroll, and trust accounts. We help you get control of it all with clean financial systems, automated reconciliations, and processes that keep you compliant.

From monthly closes to owner statements, we make your back office as organized as the properties you manage.

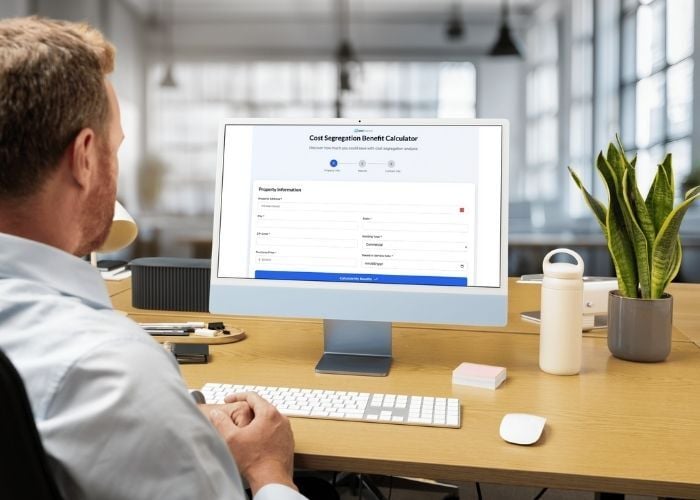

Interactive Cost Segregation Benefit Calculator

Get an instant view of your property's tax savings potential. Enter your property details, explore different scenarios, and see exactly how much you could save with accelerated depreciation.

The interactive cost segregation calculator helps you maximize deductions, plan strategically, and make informed investment decisions.

OUR SERVICES

Financial Services Built for How Real Estate Actually Works

At Iota Finance, accounting isn’t just about tracking numbers — it’s about creating clarity for smarter decisions. We combine real estate–specific bookkeeping, CFO insight, and tax strategy into one connected system designed to grow with your portfolio.

Whether you manage a few properties or a multi-entity operation, you get the financial infrastructure, analysis, and foresight to make every deal, refinance, and reinvestment move with confidence.

Accounting & Bookkeeping for Real Estate Businesses

Every smart decision starts with accurate numbers. We handle the daily accounting, reconciliations, and reporting that keep your portfolio organized and audit-ready — from rental income and property expenses to loan payments and owner distributions.

Our team builds systems that reflect how real estate actually operates, giving you a real-time view of performance by property, entity, and investment.

Fractional CFO & Financial Strategy

When your portfolio grows, so do the financial questions. We act as your on-demand CFO — forecasting cash flow, analyzing debt structures, supporting refinancing decisions, and building dashboards that track what truly drives ROI.

Whether you’re preparing for a capital raise, optimizing leverage, or scaling operations, we provide the financial leadership to guide each move with confidence.

Integrated Tax Strategy & Preparation

Tax strategy shouldn’t live in a silo — that’s why our tax services are available exclusively to clients who partner with us for accounting and bookkeeping.

This integrated model means we already know your numbers, your properties, and your goals — allowing us to build truly customized strategies for depreciation, entity structuring, and passive-loss optimization.

The result: fewer surprises, smoother filings, and tax outcomes that align with your long-term investment plan.

Let’s Make Your Financials a Strategic Advantage

If you’re building a venture-backed company and want a finance partner who understands the startup journey, we should talk. At Iota Finance, we don’t just close your books. We help you build the financial backbone your business needs to scale, raise capital, and make smarter decisions.

Let’s connect. Book a free consultation and see what it’s like to work with a team that knows what founders need, because we’ve been there.

Explore Our Latest Real Estate Accounting Insights

Not Your Father's Accountant

Subscribe to Not Your Father's Accountant—a free monthly newsletter with tax tips, news, and strategies for small businesses, startups, and real estate investors. No paywalls, just timely insights to help you make smarter decisions.