ACCOUNTING & TAX PLANNING FOR REAL ESTATE INVESTORS

Built for Real Estate Investors Who Think Like Entrepreneurs

Whether you own a few rentals or a multi-entity portfolio, Iota Finance helps you simplify accounting, optimize taxes, and make smarter reinvestment decisions.

Invest with Clarity, Operate with Confidence

Growth doesn’t just mean more doors — it means more data, more decisions, and more at stake with every move. As your portfolio expands, the real challenge isn’t buying the next property. It’s keeping a clear view of performance across entities, partners, and financing structures.

At Iota Finance, we turn fragmented records into a unified financial picture. Our connected accounting, tax, and advisory systems show exactly how your investments are performing — so you can see what’s creating value, what’s draining cash, and where to deploy capital next.

You’ve built the portfolio. We’ll help you manage it like an enterprise — with clarity, strategy, and confidence in every number.

See How A Bookkeeping & Tax Cleanup Saved These Real Estate Investors Over $730K in Taxes

When a growing real estate company came to us with a complex multi-entity structure and over 20,000 miscategorized calculations across 6+ years, we rebuilt their accounting foundation and restructured their approach—resulting in over $734,000 in tax savings.

OUR SERVICES

Real Estate Investor Accounting, Bookkeeping, and Tax Planning Services

For serious investors, every property is part of a larger financial strategy. At Iota Finance, we help you run your real estate portfolio like a business—combining precise accounting, strategic bookkeeping, and proactive tax planning to maximize after-tax returns.

Accounting & Bookkeeping for Real Estate Investors

Clean, organized books are the foundation of strong investment decisions.

We handle reconciliations, categorize income and expenses by property, and maintain detailed records across entities and partnerships.

Our systems provide real-time insights into cash flow, ROI, and portfolio performance—so you can evaluate opportunities with confidence.

Real Estate Investor Tax Planning & Strategy

Taxes can be the difference between good returns and great ones.

We develop customized real estate tax strategies that take full advantage of depreciation, 1031 exchanges, cost segregation, and passive loss optimization.

Our integrated approach ensures your tax plan aligns with your investment structure, protecting your wealth and improving long-term efficiency.

Cost Segregation and Advanced Tax Strategies

Every property holds hidden tax opportunities. We help real estate investors accelerate depreciation, unlock cash flow, and reduce taxable income through strategic cost segregation and advanced deduction planning.

Our team ensures every adjustment aligns with your accounting system and long-term tax strategy—accurate, compliant, and built to maximize after-tax returns.

From bonus depreciation to entity structuring and passive loss optimization, we make sure your portfolio captures every benefit the tax code allows.

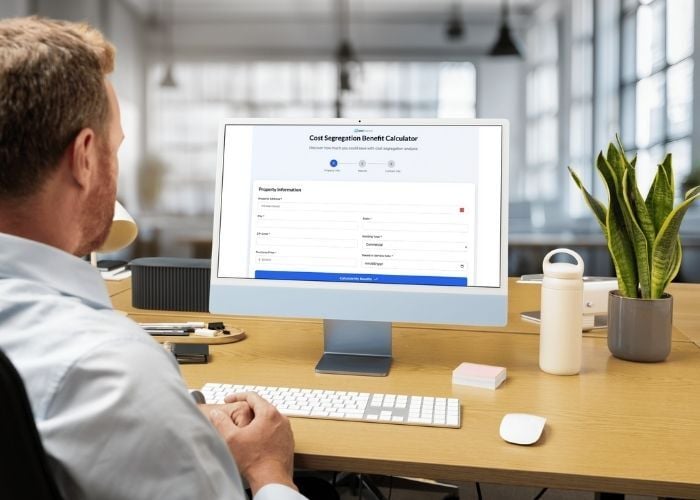

Interactive Cost Segregation Benefit Calculator

Get an instant view of your property's tax savings potential. Enter your property details, explore different scenarios, and see exactly how much you could save with accelerated depreciation.

The interactive cost segregation calculator helps you maximize deductions, plan strategically, and make informed investment decisions.

Your Portfolio Deserves a Smarter Financial Partner

You’ve built the portfolio. We’ll make sure the structure behind it performs just as well.

From entity-level accounting to long-term tax strategy, Iota Finance helps investors operate efficiently, protect wealth, and plan every move with intent.

Explore Our Latest Real Estate Accounting Insights

Not Your Father's Accountant

Subscribe to Not Your Father's Accountant—a free monthly newsletter with tax tips, news, and strategies for small businesses, startups, and real estate investors. No paywalls, just timely insights to help you make smarter decisions.