SPECIALIZED SHORT-TERM RENTAL ACCOUNTING, TAX & CFO SERVICES

Your Short-Term Rentals Deserve Long-Term Financial Strategy

We help short-term rental owners turn day-to-day operations into long-term results through connected accounting, tax strategy, and financial insight built for growth.

You Manage Guests — We’ll Manage the Numbers

Running short-term rentals isn’t passive income: it’s a full-time operation. Between variable bookings, rising costs, platform fees, and local tax rules that change from one city to the next, it’s easy to lose sight of what’s really driving profit.

Iota Finance gives you control of the numbers behind every stay. We organize your accounting, track true cash flow, and build proactive tax strategies so you can make better decisions with every booking — whether you manage one property or twenty.

With clean books, reliable data, and clear financial systems, you’ll spend less time chasing reports and more time growing your business.

See How A Bookkeeping & Tax Cleanup Saved These Real Estate Investors Over $730K in Taxes

When a growing real estate company came to us with a complex multi-entity structure and over 20,000 miscategorized calculations across 6+ years, we rebuilt their accounting foundation and restructured their approach—resulting in over $734,000 in tax savings.

OUR SHORT-TERM RENTAL ACCOUNTING SOLUTIONS

The Finance Partner Behind High-Performing Short-Term Rentals

Short-term rentals succeed on margins — and margins depend on precision. Iota Finance brings structure to the financial side of your operation, combining accounting, tax, and strategy into one connected system. From daily bookings to year-end planning, we give you the clarity to operate efficiently, stay compliant, and grow sustainably.

Accounting and Bookkeeping for Short-Term Rentals

We turn your booking data into financial clarity. Iota Finance organizes revenue, expenses, and fees across platforms into one accurate system, so you know exactly what each property earns and where your cash is going.

With clean books and reliable reporting, you can make confident decisions about pricing, reinvestment, and growth.

Occupancy Tax, Compliance, and Risk Management

Regulations and tax rules for short-term rentals change constantly. We handle occupancy taxes, state filings, and reporting requirements so your business stays compliant and protected.

The result: fewer headaches, no missed deadlines, and stronger trust with owners, investors, and regulators.

Tax Planning, Entity Structuring, and Depreciation Strategy

Short-term rentals deserve more than reactive tax prep. We help you structure ownership, apply depreciation strategically, and capture every deduction available.

It’s a proactive approach that reduces taxes, protects assets, and keeps more of your earnings working for you.

.

Financial Forecasting and Growth Strategy

Growth shouldn’t be guesswork. Our fractional CFO team builds clear forecasts and models that show how changes in pricing, occupancy, or financing will affect cash flow and ROI.

With data-driven insight, you’ll know exactly when to expand, refinance, or reinvest.

Technology, Automation, and Performance Insight

We connect your accounting, reporting, and performance data into one efficient system.

The payoff: fewer spreadsheets, faster insights, and real-time visibility into how your short-term rentals are performing—so you can scale efficiently and profitably.

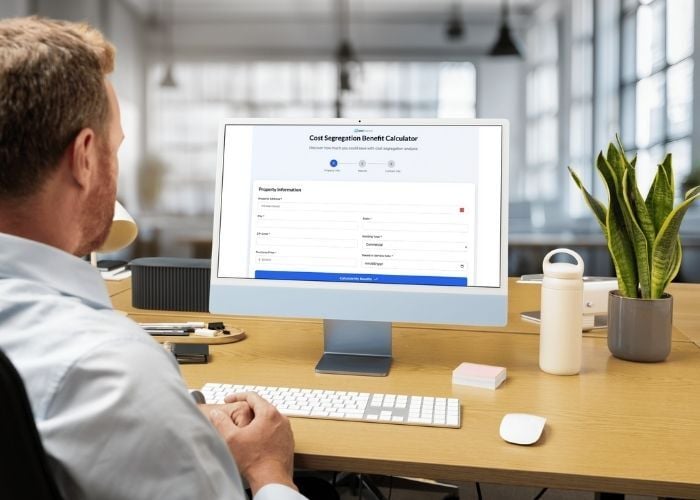

Interactive Cost Segregation Benefit Calculator

Get an instant view of your property's tax savings potential. Enter your property details, explore different scenarios, and see exactly how much you could save with accelerated depreciation.

The interactive cost segregation calculator helps you maximize deductions, plan strategically, and make informed investment decisions.

Operate Smarter. Grow Stronger. Keep More of What You Earn.

Short-term rentals can be unpredictable — your finances shouldn’t be.

At Iota Finance, we bring structure and strategy to every part of your business, helping you understand true performance, reduce taxes, and plan for sustainable growth.

You handle the guests. We’ll handle the numbers.

Explore Our Latest Real Estate Accounting Insights

Not Your Father's Accountant

Subscribe to Not Your Father's Accountant—a free monthly newsletter with tax tips, news, and strategies for small businesses, startups, and real estate investors. No paywalls, just timely insights to help you make smarter decisions.